Assessor

Mission Statement: The Saguache County Assessor’s goal is to equalize property values and ensure that the tax burden is distributed fairly and equitably among property owners within the statutory and constitutional guidelines of the State of Colorado.

Staff

Peter Peterson - Assessor

Kaye Maez - Deputy Assessor

Ranae Lamm - Field Appraiser

Miranda Arellano - Assessor Clerk

Alyssa Hammel - Assessor Clerk

Address

501 4th Street

P.O. Box 38

Saguache, CO 81149

Phone: 719-655-2521

Fax: 719-655-0152

Saguache County Parcel Viewer

DISCLAIMER: The GIS information shown on the following web pages is provided as a public resource for general information purposes only. The representation of locations in this application cannot be substituted for actual legal surveys.

Use of this information is the sole responsibility of the user; the County nor the San Luis Valley GIS/GPS Authority assumes no liability associated with errors or omissions, and/or the use or misuse of this information.

Pursuant to section 24-72-201, et seq., C.R.S.. certain records kept by Saguache, Colorado in the normal course of business are open to inspection by the public at reasonable times. However, the County makes no representation as to the accuracy or content of the information contained in these records

Some of the information contained in the Saguache, Colorado Assessors records is derived from other sources and that information should be verified by consulting said sources. This data is subject to change in accordance with the Assessors calendar.

The Data Sets and or maps being displayed hereafter are neither legally recorded maps or surveys, and are not intended to be used as such. The source DATA is a unique compilation of records, information and data from various city, county, state, federal offices, and other sources and should be used for general reference only. Saguache County makes no representation or warranty as to its accuracy, timeliness, or completeness, and in particular, its accuracy in labeling or displaying dimensions, contours, property boundaries, or placement or location of any map features thereon.

Saguache County and the San Luis Valley GIS/GPS Authority MAKES NO WARRANTY OF MERCHANTABILITY OR WARRANTY FOR FITNESS OF USE FOR A PARTICULAR PURPOSE, EXPRESSED OR IMPLIED, WITH RESPECT TO THESE MAP PRODUCTS OR THE UNDERLYING DATA. Any users of these map products, map applications, or data, accepts same AS IS, WITH ALL FAULTS, and assumes all responsibility for the use thereof, and further covenants and agrees to hold the County harmless from and against all damage, loss, or liability arising from any use of this map product, in consideration of the County's having made this information available

Independent verification of all data contained herein should be obtained by any user of these map products, or the underlying data. The County disclaims, and shall not be held liable for, any and all damage, loss, or liability, whether direct, indirect, or consequential, which arises or may arise from these map products or the use thereof by any person or entity.

EagleWeb Property Search

The information contained herein is believed to be accurate and dependable. However, no warrantees implied or expressed exist regarding the veracity of the data. Indicated taxable values are for assessment purposes only and may or may not reflect the estimate of current market value by this office. Please contact us if you have any questions regarding the use of this application.

Valuation Increases Expected for most County Property Owners

(May 1, 2025) – Saguache County, CO --- Property owners in Saguache County can expect valuation increases when they receive their 2025 Notice of Valuation on or about May 1. Over the past two years, the demand for real estate in Saguache County, influenced by buyers looking for affordability from areas of Colorado where property values have increased significantly has increased. In addition, increased building material costs, and a continued steady migration from larger cities to rural Colorado have all contributed to valuation increases. Rural Colorado continues to be discovered, and people are paying much higher prices for properties for the opportunity to live here.

Under Colorado law, county assessor offices throughout the state conduct a complete revaluation of all properties in their county every two years. The previous valuations were based on a June 30, 2022, level of value. These valuations used market sales data from July 1, 2020, through June 30, 2022. The new 2025 valuations are based on a June 30, 2024, level of value and were established using market sales data from July 1, 2022, through June 30, 2024. These new valuations will be used for tax years 2025 and 2026 (payable in 2026 and 2027 respectively). Any sales transactions occurring after June 30, 2024, cannot be used or considered until the next reappraisal in 2027. The Colorado Law sets the appraisal date, the market sales data collection period, and the annual calendar for the assessment process.

The Colorado Legislature has lowered assessment rates for tax year 2025 and Senate Bill 24-233 created split assessment rates for school and non-school taxing authorities. In addition, House Bill 24B-1001 creates limits for property tax revenue. A summary of the bill can be viewed here: Property Tax | Colorado General Assembly

Tax calculations also take mill levies into account. Mill levies are established by the county commissioners, school districts, and the boards of the various taxing entities such as fire, recreation, library, sanitation, cemetery, etc. A summation of these various individual levies is applied to the assessed value to determine the taxes due. It is undetermined at this time what the 2025 mill levies will do since the taxing entities will not set their 2025 mill levies until later this fall during their budget hearings.

The assessor’s office is solely responsible for establishing valuations, not taxes. To accomplish this, the assessor uses actual market sales transactions to build a mass appraisal valuation model that is then used to set the values on all properties within the county. With the 2020 repeal of the Gallagher Amendment to the State Constitution, assessment rates are now dictated by the Colorado Legislature for all 64 Colorado Counties.

Ultimately, the assessor’s goal is to equalize property values and ensure that the tax burden is distributed fairly and equitably among property owners within the statutory and constitutional guidelines of the State of Colorado.

Property owners have recourse through exemptions for those who qualify, and protests.

“There are exemptions for seniors, disabled veterans and gold star spouses,” Saguache County Assessor, Peter Peterson, explained. “Veterans, seniors and gold star spouses must apply through the Saguache County Assessor's Office. Seniors must be 65 years old as of January 1 and have owned/lived in their house as their primary residence for 10 years or more. The exemption exempts half of the first $200,000 of property's actual value from taxes.”

The protest deadline is June 9 this year. These need to be hand delivered or postmarked by June 9th, 2025.

For questions about your property value, please call (719) 655-2521 or email ppeterson@saguachecounty-co.gov

2025 Notices of Valuation

39-5-121. Notice of Valuation - Legislative Declaration (1) (a) (I): no later than May 1 in each year, the assessor shall mail to each person who owns land or improvements a notice setting forth the valuation of such land or improvements.

Most property in Colorado is revalued every odd-numbered year, § 39-1-104(10.2)(a), Colorado Revised Statute (C.R.S.).

Your property was valued as it existed on January 1 of the current year. The value of the residential property is based on the market approach to value. Generally, the value of all other property is based on consideration of the market, cost, and income approaches to value. The appraisal data used to establish value is from the 18-month period ending June 30, 2024, § 39-1-104(10.2)(a), C.R.S. If insufficient data existed during the 18-month data-gathering period, data from each preceding six-month period (up to a period of five years preceding June 30, 2024) may be utilized, § 39-1-104(10.2)(d), Colorado Revised Statutes (C.R.S). The Assessor’s Office utilized 24 months of sales for Vacant and Residential properties. For Commercial properties 5 years of sales data was utilized.

Most property in Colorado is revalued every odd-numbered year, § 39-1-104(10.2)(a), C.R.S.

If you have found a discrepancy in the Assessor's records, please let our office know. Correct and complete assessment records are the first step in assuring that the value placed on your property is correct. While an informal review is not necessary to appeal your property value, it can be beneficial in avoiding an appeal.

Should you wish to speak directly with a member of the Assessor's appraisal staff regarding your value, please feel free to phone our office at 719-655-2521. Please keep in mind that this office experiences heavy call volume during the appeals process. This can result in longer wait times so we appreciate your patience. I can assure you that we will make every attempt to answer all calls timely, each call we receive is given as much time as necessary to answer all questions.

Notice of Valuation

After reviewing your inventory, comparing like-properties and reviewing sales, you still feel that your property value is incorrect, an appeal may be in order. Please file your appeal in writing, the back of your Notice of Valuation (NOV) is the official Appeal Form. Please be as clear as possible in stating the reasons you feel your property value or classification is incorrect.

Important

All supporting documentation must be sent in at the time you file your appeal!

2025 SAGUACHE COUNTY REAPPRAISAL

- Colorado Statue directs All Colorado County Assessors to conduct revaluations in every odd numbered year.

- Colorado law directs all 64 County Assessors to analyze sales data and adjust all qualified sales to the market conditions that existed on what is commonly referred to as the "Appraisal Date." The appraisal date for this reassessment is June 30, 2024.

- For 2025 the Saguache Assessor's office along with all Colorado Assessor's start from scratch and build new value estimates using qualified transactions that have occurred prior to June 30th• 2024. Sale transactions or real estate market influences after June 30th• 2024 cannot be considered in this process.

- Time adjusted sale price refers to a sale price that has been adjusted for changes in market conditions that have occurred in a given real estate market over time. Colorado Law requires Assessors to analyze sales data and "Adjust all qualified sales to the market conditions that existed on what is commonly referred to as the appraisal date.'' The appraisal date for this reassessment is June 30, 2024. The Colorado Statute which specifies this is§ 39-1-104{10.2)(a}. Colorado law is further interpreted by a 2011 Colorado Court of Appeals case Kidder v. Chaffee County in which the court ruled that "Adjustment for time under subsections {10.2)(a} and {10.2)(d} is not discretionary, but mandatory.''

- There is no time adjustment for Saguache County for the 2025 reappraisal.

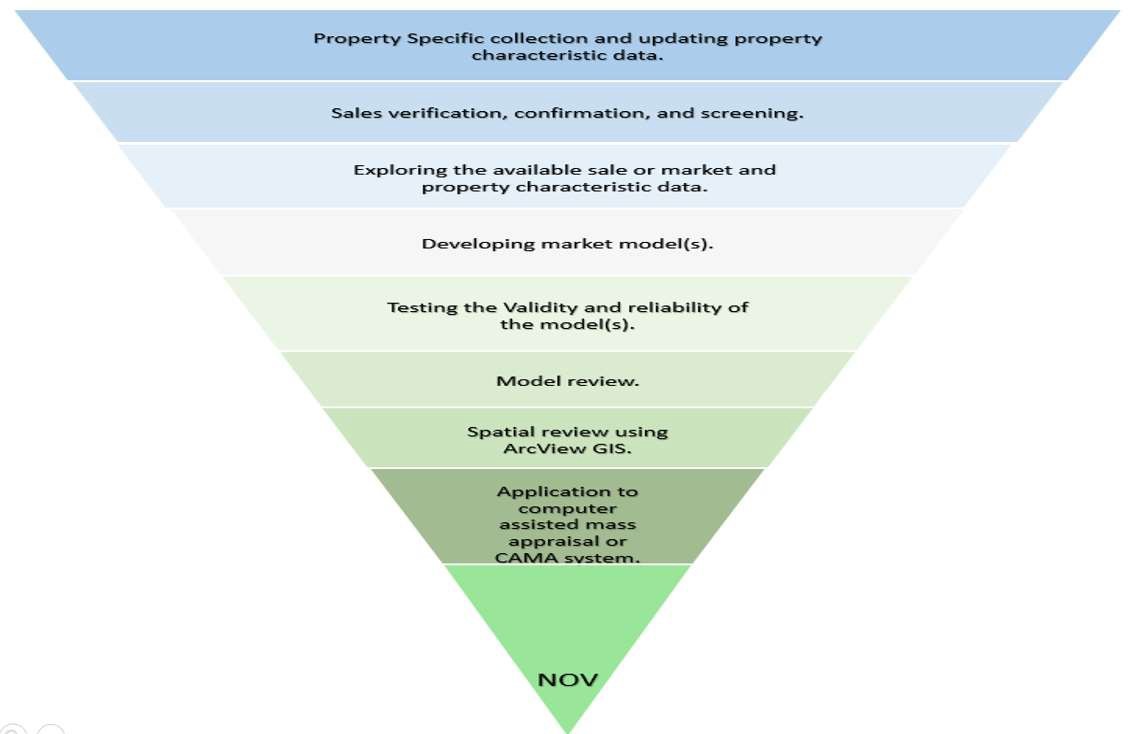

MASS APPRAISAL

- Assessment Jurisdictions have been dealing with the problem of valuing massive quantities of properties in a short time period for years.

- They began the innovation of valuation as communities grew and the number of properties to assess increased.

- Mass appraisal is the systematic appraisal of groups of properties as of a given date using standardized procedures and statistical testing.

- Mass appraisal requires the development of a valuation model capable of replicating the forces of supply and demand.

- In mass appraisal statistical methods are used in analyzing the accuracy and consistency of values produced by the model.

- Mass Appraisal solves the problem of valuing massive quantities of properties in a short time period.

Real Property Appeal Procedures

By Mail

If you wish to appeal in writing, please include your estimate of property value as of June 30, 2024, and any additional documentation that you believe supports a change in the classification and/or valuation of your property. Written protests must be postmarked no later than June 8th and should be addressed to:

Saguache County Assessor's Office

P.O. Box 38

Saguache, CO 81149

Appeal period: May 1, 2025 - June 9, 2025

In Person

If you wish to appeal in person, present to the Assessor's office your estimate of property value as of June 30, 2024, and a copy of any documentation that you believe supports a change in the classification and/or valuation of your property. You must appear in the office of the County Assessor no later than June 8, § 39-5-122(2), C.R.S.

Appeal period: May 1, 2025 - June 9, 2025

Last Updated: 05/02/2025